- Analítica

- Visão do mercado

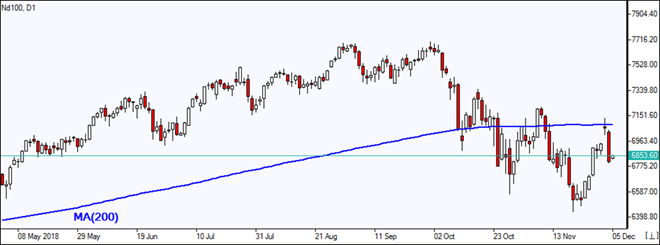

Trump-Xi agreement success concerns weigh on equities - 5.12.2018

Dollar strengthens as yield curve inverts

US stock market slumped on Tuesday wiping prior session gains spurred by US-China trade tensions easing after Trump-Xi meeting over the weekend. The S&P 500 dropped 3.2% to 2700.06 led by finance and industrial shares. Dow Jones industrial average tumbled 3.1% to 25027.07. The Nasdaq sank 3.8% to 7158.43. The dollar strengthening resumed despite the yield on five-year government debt sliding below the yield on three-year debt on Monday, known as inverting of the yield curve. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up 0.02% to 96.956 and is higher currently. US market is closed today for the funeral of the former President George H.W. Bush, who died Friday at 94.

DAX 30 slips the most among major European indices

European stocks gave up most of previous session gains on Tuesday. The EUR/USD joined GBP/USD’s continued slide and both are lower currently. The Stoxx Europe 600 lost 0.8%. The German DAX 30 fell 1.1% to 11335.32. France’s CAC 40 slid 0.8% and UK’s FTSE 100 lost 0.6% to 7022.76.

Hang Sang leads Asian indices losses

Asian stock indices are in red today after a selloff on Wall Street overnight. Nikkei lost 0.5% to 21919.33 despite resumed yen slide against the dollar. Chinese stocks turned lower: the Shanghai Composite Index is down 0.6% and Hong Kong’s Hang Seng index is 1.6% lower. Australia’s All Ordinaries Index extended losses 0.8% as Australian dollar continued its slide against the greenback after third quarter GDP data came in below expectations.

Brent down on US supply glut

Brent futures prices are falling today after the American Petroleum Institute late Tuesday report indicated US crude inventories rose by 5.4 million barrels last week to 448 million. Prices rose yesterday: February Brent gained 0.6% to $62.08 a barrel Tuesday.

Veja também