- Analítica

- Disposição do mercado

Healthcare reform setback hurts dollar sentiment

US dollar bullish bets fell to $15.28 billion from $18.46 billion against the major currencies during the previous week, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to March 28 released on Friday March 31. Economic data during the week were mixed and Trump administration’s failure to secure support for healthcare reform caused a pause in recent stock market rally with investors wondering about President Trump’s ability to deliver on his promises of economic stimulus measures to boost US growth.

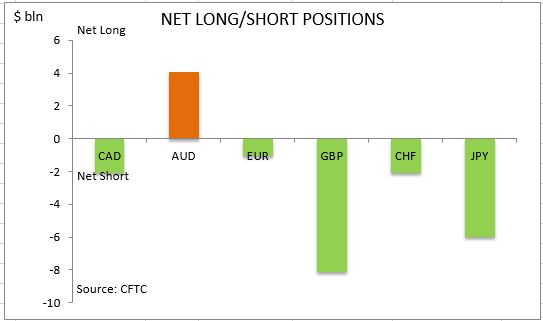

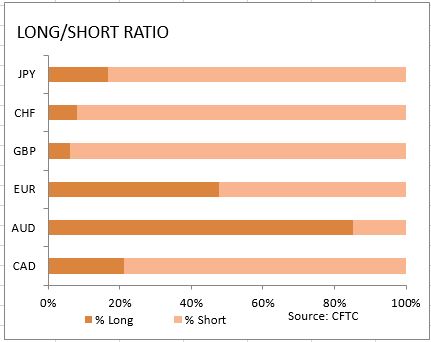

President Trump withdrew his proposed health care law designed to replace Obamacare, spurring concerns about his ability to push pro-growth legislation through Congress after his failure to garner support for health care bill, his first legislative initiative. Expectations of stimulus measures such as tax cuts and increased infrastructure spending drove recent stock market rally, and signs that proclaimed policies will not materialize weigh on economy’s growth prospects and hurt dollar’s strength. Economic data were mixed: New Home Sales rose in February while Existing Home Sales fell, the rise in Durable Goods Orders slowed in February as did the growth in services and manufacturing sectors evidenced by Services and Manufacturing PMIs. Investors reduced the dollar bullish bets for eighth time in twelve weeks. As is evident from the Sentiment table, sentiment deteriorated for Canadian dollar and Swiss franc. And the Australian dollar is still the only major currency held net long against the US dollar.

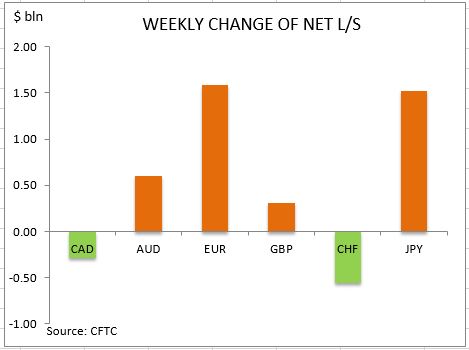

The euro sentiment improved markedly with flash Manufacturing and Services PMI readings indicating accelerating expansion in German and French manufacturing and services sectors in March. The net short euro position fell $1.6bn to $1.10bn, its lowest since 2014. Investors built the gross longs and cut shorts by 4058 and 7735 contracts respectively. The British Pound sentiment as retail sales grew 1.4% in February following a downwardly revised 0.5% contraction the previous month. The net short position in British Pound narrowed $0.3bn to $8.1bn as investors increased the gross longs and covered shorts by 2469 and 1300 contracts respectively. The bearish Japanese yen sentiment improved as the balance of trade for February turned positive after showing deficit in January. The net short position narrowed $1.5bn to $5.98bn. Investors built the gross longs and covered shorts by 7847 and 5959 contracts respectively.

The Canadian dollar sentiment continued to deteriorate as inflation slowed in February: the net short Canadian dollar position widened $0.3bn to $2.11bn. Investors increased both the gross longs and shorts. The bullish Australian dollar sentiment continued to intensify as net longs rose by $0.6bn to $4.1bn. Investors built the gross longs and covered shorts. The sentiment toward the Swiss franc Swiss franc deteriorated with the net shorts widening by $0.5bn to $2.1bn. Investors cut the gross longs and built shorts.

CFTC Sentiment vs Exchange Rate

| March 28 2017 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | negative | -2110 | -282 |

| AUD | bullish | negative | 4055 | 602 |

| EUR | bearish | negative | -1071 | 1587 |

| GBP | bearish | positive | -8101 | 308 |

| CHF | bearish | negative | -2066 | -558 |

| JPY | bearish | negative | -5986 | 1525 |

| Total | -15277 |

Nova ferramenta analítica exclusiva

Qualquer período- de 1 dia a 1 ano

Todos os grupos- Forex, Ações, Índices, etc.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.

Ultimas previsões

- 18mar2021Líderes de Crescimento e Queda: dólar canadense e iene japonês

Nos últimos 7 dias, os preços do petróleo, dos metais não ferrosos e outras matérias-primas minerais, embora tenham descido, mesmo assim, se mantiveram em um nível elevado. Graças a isso, houve um fortalecimento das moedas dos países de commodities: o dólar canadense, os dólares australiano...

- 10mar2021Líderes de Crescimento e Queda: Dólar canadense e dólar neozelandês

Nos últimos 7 dias, os preços do petróleo continuaram subindo. Devido a isso, houve um fortalecimento das moedas dos países produtores de petróleo: o rublo russo e o dólar canadense. O dólar da Nova Zelândia enfraqueceu após a publicação de indicadores econômicos negativos: ANZ Business Confidence...

- 4mar2021Líderes de Crescimento e Queda: Dólar americano e rand sul-africano

Nos últimos 7 dias, os preços do petróleo continuaram crescendo. Os metais preciosos, incluindo ouro, caíram de preço. Neste contexto, se verificou o aumento das ações petrolíferas, o fortalecimento do rublo russo e o enfraquecimento dos dólares australiano e neozelandês, bem como do rand sul-africano....