- Analítica

- Análise Técnica

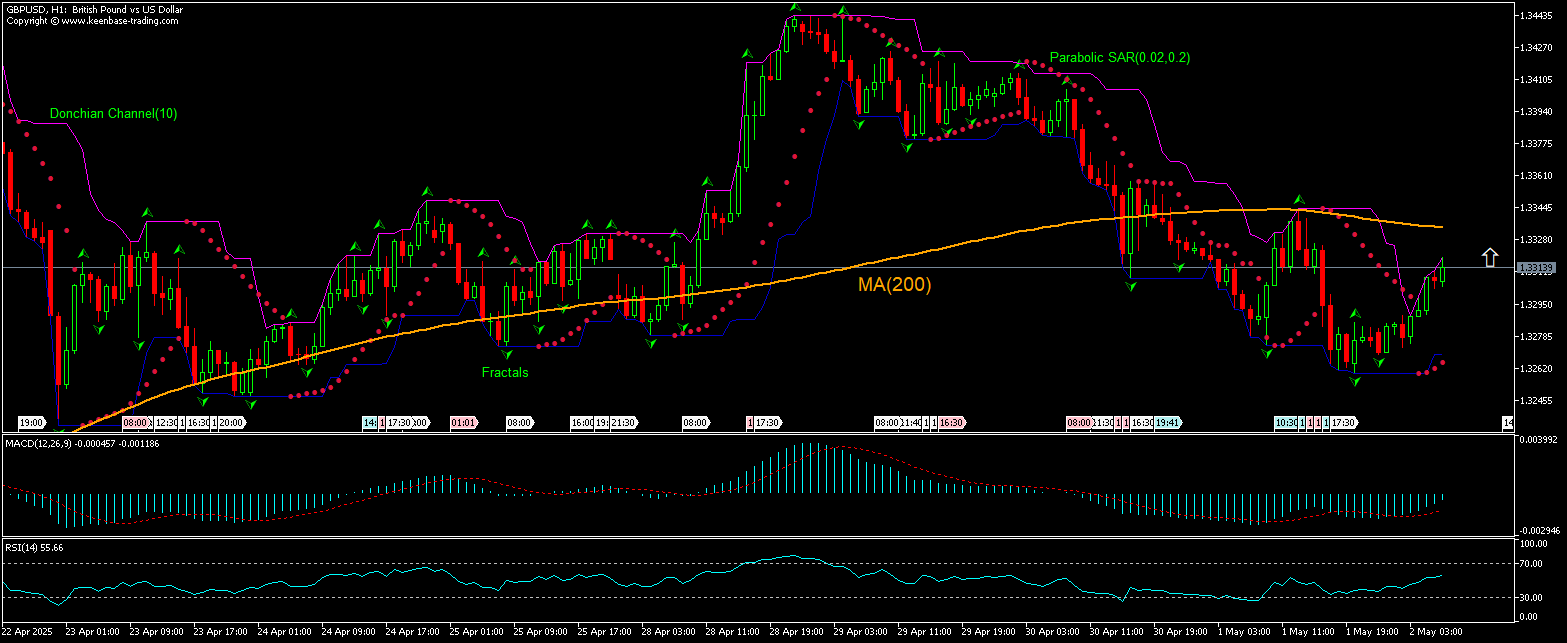

GBP/USD Análise técnica - GBP/USD Negociação: 2025-05-02

GBP/USD Resumo da Análise Técnica

acima de 1.33207

Buy Stop

abaixo de 1.32741

Stop Loss

| Indicador | Sinal |

| RSI | Neutro |

| MACD | Comprar |

| Donchian Channel | Comprar |

| MA(200) | Vender |

| Fractals | Comprar |

| Parabolic SAR | Comprar |

GBP/USD Análise gráfica

GBP/USD Análise Técnica

The GBPUSD technical analysis of the price chart on 1-hour timeframe shows GBPUSD: H1 is rising to test the 200-period moving average MA(200) after hitting 1-week low yesterday. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 1.33207. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1.32741. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análise Fundamental de Forex - GBP/USD

Recent UK data were weak. Will the GBPUSD price rebound reverse?

While S&P Global upgraded UK manufacturing sector performance data, the final reading still indicates UK manufacturing sector contracted in April: the Manufacturing PMI was revised up to 45.4 for April, slightly higher than March’s 17-month low of 44.9 and above the preliminary reading of 44.0. Readings above 50.0 indicate industry expansion, below indicate contraction. And the Bank of England reported UK consumer credit growth was at 9-month low: net consumer credit borrowing by individuals in the United Kingdom was £0.9 billion in March, the lowest level since last June, down from the revised £1.3 billion in February and missing market forecasts of £1.2 billion. The annual growth rate for all consumer credit decreased to 6.1% in March from 6.4% in February. At the same time, UK mortgage approvals fell more than expected: Mortgage Approvals fell by 800 to 64,300 in March, below market expectations of 64,800. Net mortgage approvals for house purchases is an indicator of future borrowing, and the decline in March was the third in a row. Weak UK economic data are bearish for Pound and GBPUSD currency pair. However, the current setup is bullish for GBPUSD.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.