- Analítica

- Líderes de crescimento e queda

Top Gainers and Losers: Coffee and the Australian Dollar

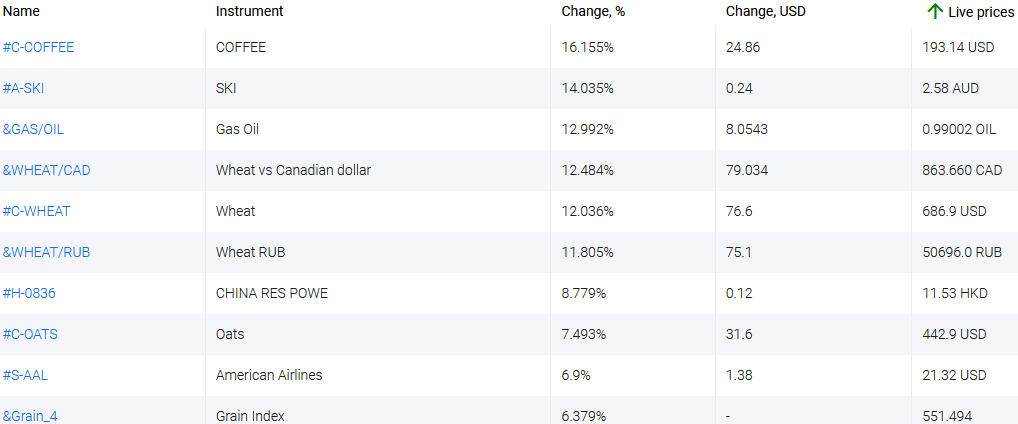

Growth Leaders - global market

Growth Leaders - global market

Over the past 7 days, the US dollar index rose for the second time in anticipation of a tightening of U.S. monetary policy. Federal Reserve. The Australian dollar weakened after the RBA Meeting Minutes and weak June retail sales data. Investors fear that the Reserve Bank of Australia will change its mind about cutting the economic stimulus program. Its next meeting will be on August 3. A meeting of the South African Reserve Bank took place on July 22. He kept the rate at 3.5%, but at the same time raised the forecast for South African GDP growth to 4.2% and lowered the inflation forecast to 4.3% (4.9% in June). This helped to strengthen the South African rand. The Canadian dollar weakened against the background of the correction in world oil prices. Coffee quotes have skyrocketed since November 2014 due to bad weather in Brazil. Conab expects Brazil's coffee harvest to decline this year by 23% to a 4-year low of 48.8 million bags.

1.COFFEE, +16,1% – Arabica coffee CFDs

2. Spark Infrastructure Group, +14% – Australian power investment fund

Loss Leaders - global market

Loss Leaders - global market

1. China Evergrande Group – Chinese investment, development and construction company

2. &SumOIL/GAS – personal composite tool Brent and WTI against US natural gas.

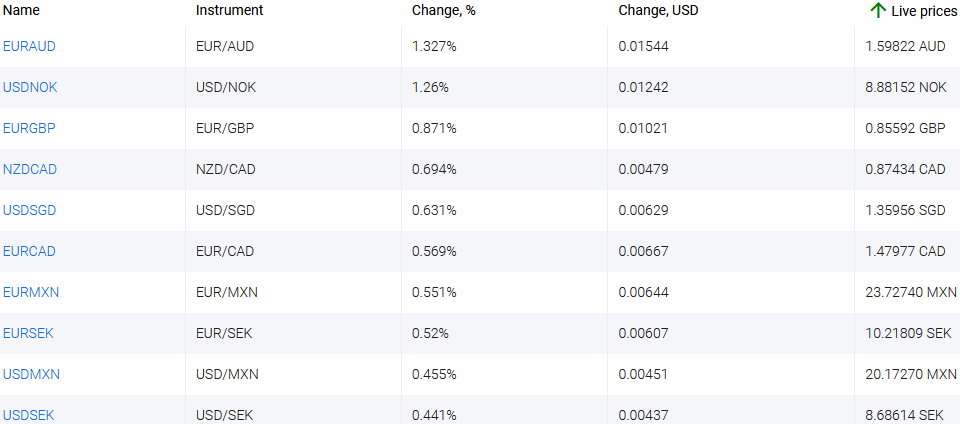

Growth Leaders - foreign exchange market (Forex)

Growth Leaders - foreign exchange market (Forex)

1. EURAUD, EURGBP - the growth of these charts means the strengthening of the euro against the Australian dollar and the British pound.

2. USDNOK, NZDCAD - the rise in these charts means weakening of the Norwegian krone and the Canadian dollar against the US and New Zealand dollars.

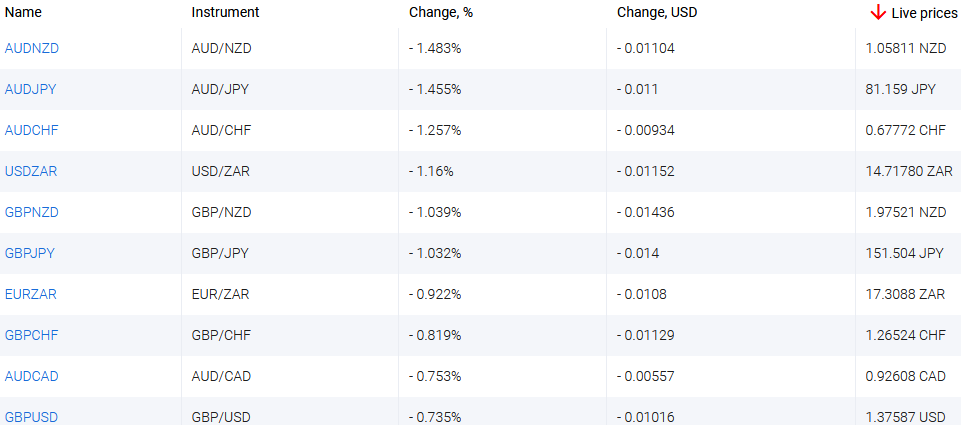

Loss Leaders - foreign exchange market (Forex)

Loss Leaders - foreign exchange market (Forex)

1. AUDNZD, AUDJPY - the drop in these charts means a weakening of the Australian dollar against the New Zealand dollar and the Japanese yen.

2. AUDCHF, USDZAR - the decline in these charts signifies the strengthening of the Swiss franc against the Australian dollar and the strengthening of the South African rand against the US dollar.

Nova ferramenta analítica exclusiva

Qualquer período- de 1 dia a 1 ano

Todos os grupos- Forex, Ações, Índices, etc.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.

Líderes Anteriores em Crescimento e Queda

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...